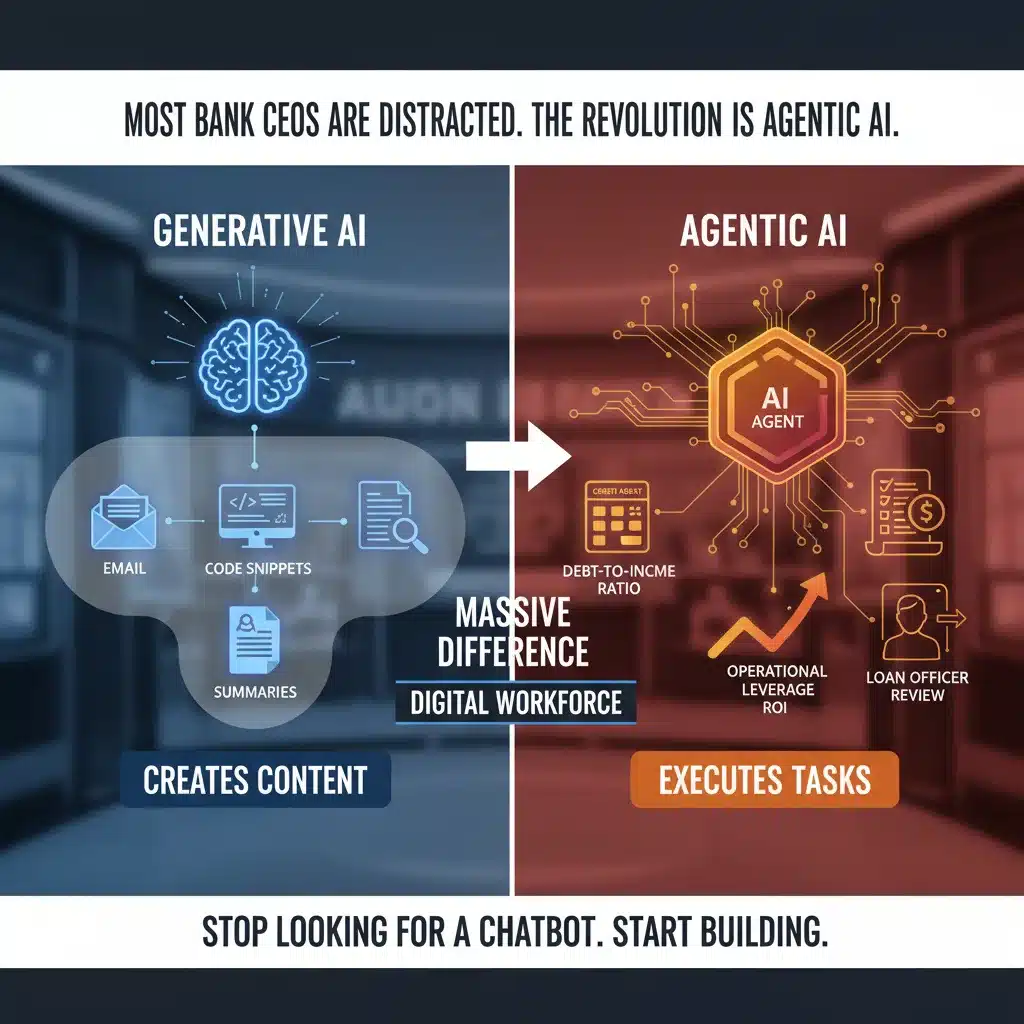

Many bank CEOs are currently focused on Generative AI, but the true transformation for the industry lies in Agentic AI, which is fundamentally different. While Generative AI produces content—such as emails, code, or summaries—Agentic AI takes action by executing tasks, managing workflows, making API calls, and supporting decision-making.

In banking, this distinction is clear: Generative AI can draft a courteous email explaining a loan denial, but Agentic AI can process the loan application, retrieve the credit report, assess the debt-to-income ratio based on your institution’s policies, and alert a loan officer for review. Generative AI serves as a productivity enhancer, whereas Agentic AI delivers operational leverage.

For mid-market banks, the focus should shift from chatbots to building a digital workforce, as the real return on investment comes from execution, not just conversation.